Press Releases

Time for unity; the military and their collaborators should belong in the ash heap of history

ARNO firmly declares its position as being with the freedom-loving people of Myanmar, who are currently waging a historic resistance against the evil forces of the Myanmar military throughout the country. Never in the history of this nation have people from all walks...

Latest News

Time for unity; the military and their collaborators should belong in the ash heap of history

ARNO firmly declares its position as being with the freedom-loving people of Myanmar, who are currently waging a historic resistance against the evil forces of the Myanmar military throughout the country. Never in the history of this nation have people from all walks...

ARNO condemns violence in the Arakan state as fighting between the Myanmar Military and AA continues

Over the course of recent weeks, the fighting in the Arakan (Rakhine) has continued to escalate between the Myanmar military junta and the Arakan Army (AA). On January 28, residents in North Maungdaw reported a loud explosion and 20 homes were burnt to ashes....

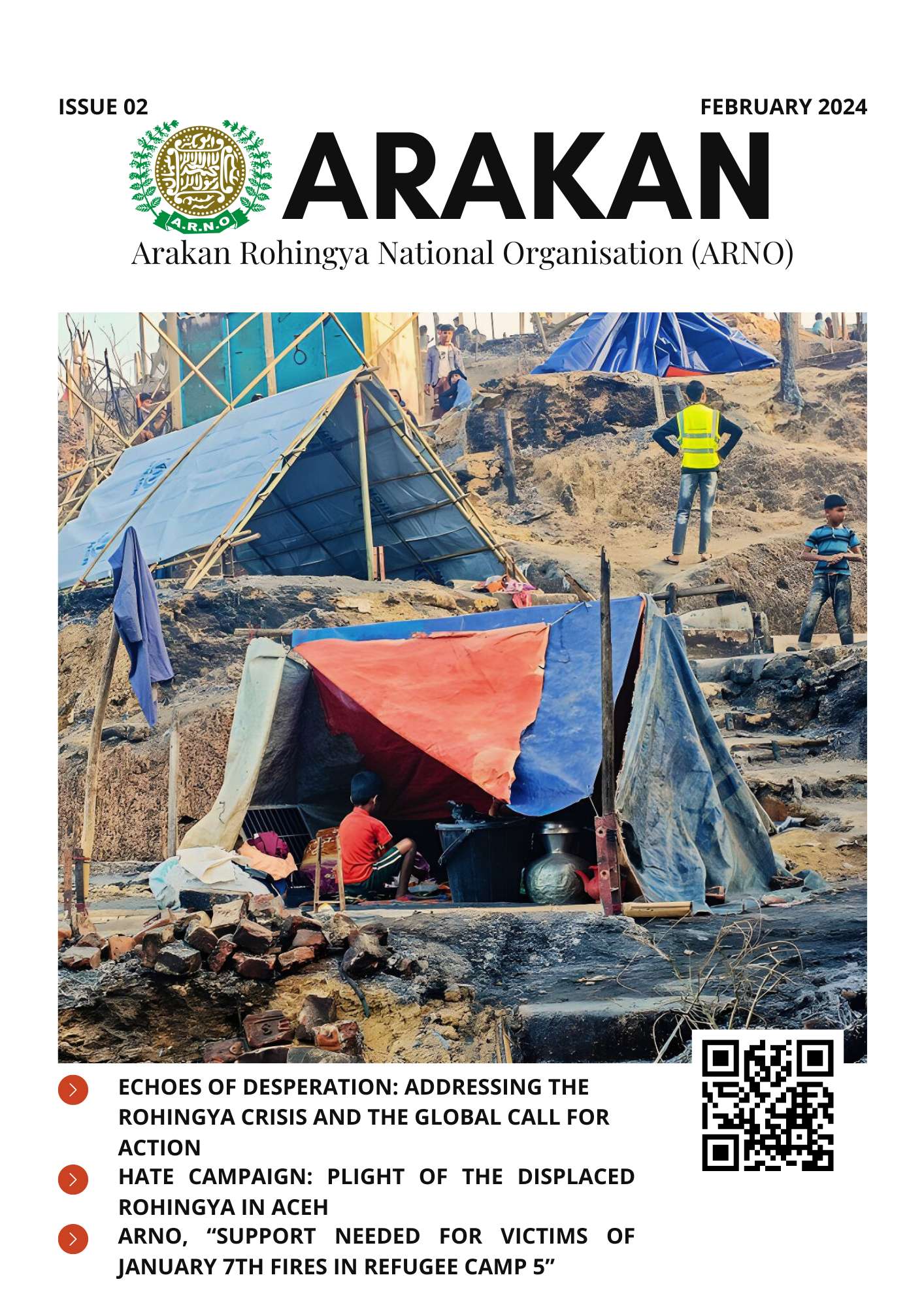

Press Release: Support Needed for Victims of January 7th Fires in Refugee Camp 5

The Arakan Rohingya National Organisation (ARNO) expresses its condolences to our brothers and sisters who have lost their temporary shelters in Camp 5. Around 12:45, a fire started in Camp 5. The fire destroyed approximately 774 shelters and 12 learning facilities....

Press Release: ARNO requests coordinated efforts to stop hate speech and disinformation

During the last week of December 2023, disturbing reports emerged from Aceh, Indonesia, that student protestors stormed a shelter that was provided to Rohingya refugees who recently arrived by boat. The student protestors “evicted” the Rohingya. The Arakan Rohingya...

Wishing You a Prosperous 2024 and Announcing the Relaunch of “Arakan Magazine”

Dear Esteemed Readers, ARNO Members, Friends, and the General Public, As we stand at the threshold of a new year, it is with great joy and optimism that we extend our warmest wishes to the resilient Rohingya people, our dedicated ARNO members and friends, and the...

ARNO condemns military build-up in Arakan, led by Myanmar Junta

09 November, 2023 The Arakan Rohingya National Organisation (ARNO) has learned that the Myanmar military junta is deploying forces all over the Rakhine (Arakan) state in Burma. ARNO is not surprised that barely a week after visiting Bangladesh to assess the...

Landmark visit by Ethnic and Religious Minority Groups from Burma

[NEW YORK – 23 OCTOBER] Representatives of a diverse cross-section of Burmese ethnic and religious minority groups, including representatives of the Rohingya, Burmese Muslim, Kachin, Chin, and Karen communities, concluded an important diplomatic visit to New York as...

ASEAN APPROACHES TO CHALLENGES IN THE ARAKAN AND THE MILITARY JUNTA

Evaluation by the Arakan Rohingya National Organisation Introduction The Association of South East Asian Nations (ASEAN) is an intergovernmental organization that brings together ten nations in Southeast Asia.[1] Myanmar, which is included among these ten...

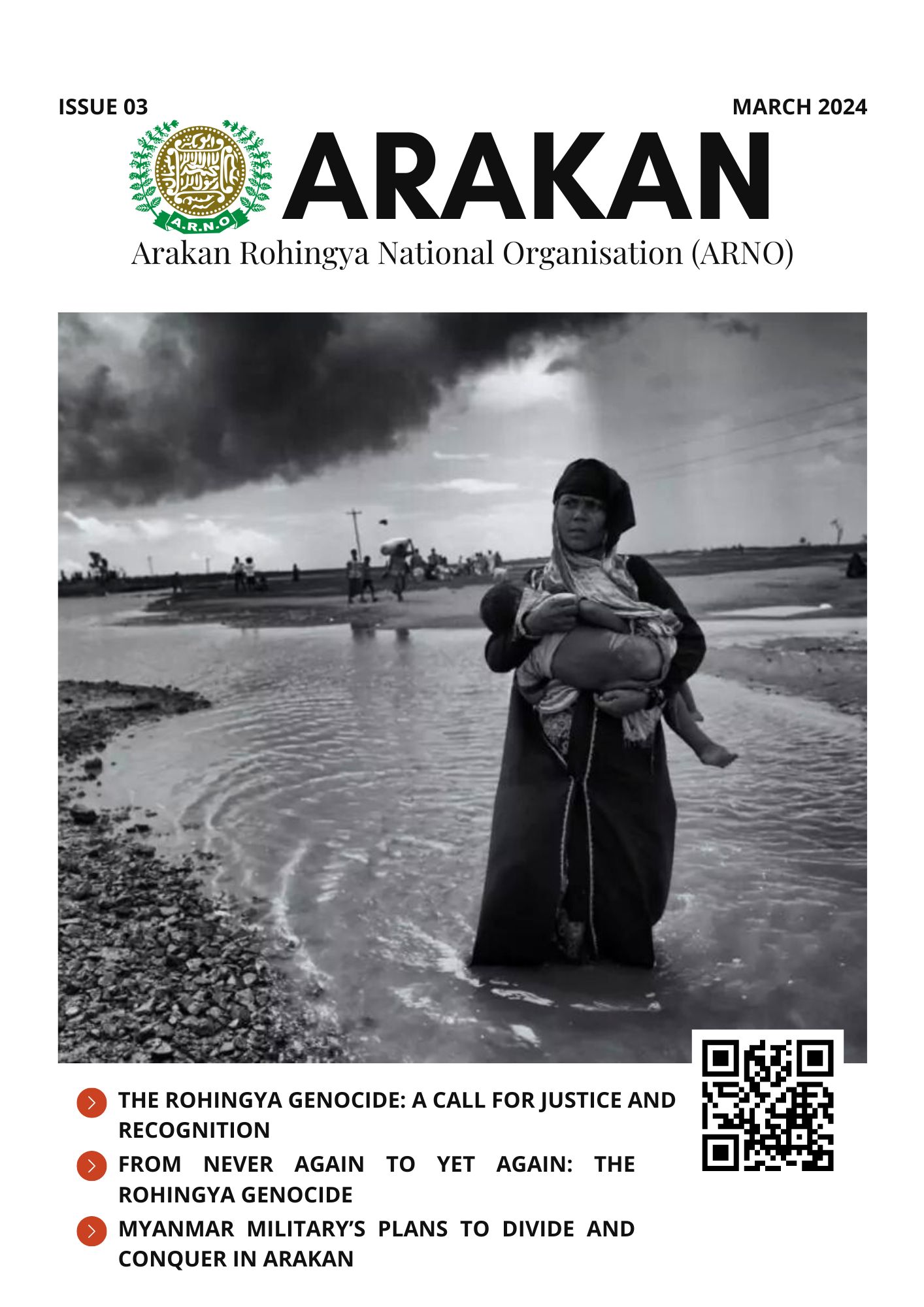

Arakan Magazine

Reports

Assessment of the Annan Commission Recommendations

I. Introduction Recently, significant activity concerning the Rohingya repatriation to the Arakan have taken place between the Government of Bangladesh and the military junta in Myanmar. Parallel to these bilateral initiatives, many governments are beginning to...

Rohingya Library

All ABOUT ROHINGYA

Press Release

Time for unity; the military and their collaborators should belong in the ash heap of history

ARNO firmly declares its position as being with the freedom-loving people of Myanmar, who are currently waging a historic resistance against the evil forces of the Myanmar military throughout the country. Never in the history of this nation have people from all walks...

ARNO condemns violence in the Arakan state as fighting between the Myanmar Military and AA continues

Over the course of recent weeks, the fighting in the Arakan (Rakhine) has continued to escalate between the Myanmar military junta and the Arakan Army (AA). On January 28, residents in North Maungdaw reported a loud explosion and 20 homes were burnt to ashes....

Press Release: Support Needed for Victims of January 7th Fires in Refugee Camp 5

The Arakan Rohingya National Organisation (ARNO) expresses its condolences to our brothers and sisters who have lost their temporary shelters in Camp 5. Around 12:45, a fire started in Camp 5. The fire destroyed approximately 774 shelters and 12 learning facilities....

Press Release: ARNO requests coordinated efforts to stop hate speech and disinformation

During the last week of December 2023, disturbing reports emerged from Aceh, Indonesia, that student protestors stormed a shelter that was provided to Rohingya refugees who recently arrived by boat. The student protestors “evicted” the Rohingya. The Arakan Rohingya...

Landmark visit by Ethnic and Religious Minority Groups from Burma

[NEW YORK – 23 OCTOBER] Representatives of a diverse cross-section of Burmese ethnic and religious minority groups, including representatives of the Rohingya, Burmese Muslim, Kachin, Chin, and Karen communities, concluded an important diplomatic visit to New York as...

ARNO calls upon South Asian Media to stop scapegoating Rohingya People

The Arakan Rohingya National Organisation (ARNO) immediately calls upon media outlets throughout South Asia to be responsible and ethical in their coverage of the violence which is taking place in Manipur and other parts of North India. Recently, media outlets are...

2 years after the Coup, the people of Burma are worse off

ARNO is saddened to continue to report that after two years of the coup which took place on February 1, 2021, by the Myanmar military (junta) that the conditions in Burma continue to deteriorate and have not improved. As the international community is aware, the...

ARNO condemns Junta award to Wirathu, terrorist and genocidaire

Today the Myanmar military (junta) awarded Buddhist Monk, Wirathu, the honorific title “Thiri Pyanchi” for “his outstanding work for the good of the Union of Myanmar” as reported by the junta’s information teams and subsequently reported by international media...

THE ROHINGYA GENOCIDE DAY WILL NOT AND CANNOT BE FORGOTTEN

(25 August 2022) The “Rohingya Genocide Day” of August 25 is a memorable day for our people and generations. For decades, the Myanmar brute forces and state-sponsored non-state actors have carefully pre-planned genocidal onslaughts against our innocent people....

Burma continues to suffer as a result of February 1, 2021 coup

February 1, 2022 The Arakan Rohingya National Organisation condemns the Tatmadaw’s illegal takeover of Burma/Myanmar since February 1, 2021. The international community is aware that one year ago, Tatmadaw, the military junta of Burma, perpetrated a coup against Daw...

Experts Writing

Coming To Defense Of Persecuted Is Noble And Not Bullying – OpEd

On Friday, December 27, 2019, a resolution titled “Situation of human rights of Rohingya Muslims and other minorities in Myanmar”was passed with an overwhelming majority of votes during the 74th session of UN General Assembly at its 52nd resumed meeting, held at...

The arc of history can bend towards justice for the Rohingya

* Any views expressed in this opinion piece are those of the author and not of Thomson Reuters Foundation. What happened to the Rohingya is a stain on the history of humanity. But the arc of history has a way of bending towards justice. Nurul Islam is the Chairman of...

Traditional Homeland of Rohingya in Myanmar

The area between west bank of Kaladan River and east bank of Naf River, which demarcates Myanmar-Bangladesh border, in North Arakan is known as “Traditional Homeland of Rohingya”. It has been deeply implanted the minds of the Rohingya people despite changes in...

Safe Zone For Rohingya In Myanmar

Since Gen. Ne Win’s military coup in Burma/Myanmar in 1962, the Rohingya have faced continuous process of de-legitimisation, institutionalised persecution, crimes against humanity and worsening abuses culminating into one of the gravest genocides of the modern era....

The Rohingya are not going home to Myanmar. Can Bangladesh cope?

Azeem Ibrahim is a director at the Center for Global Policy and author of “Rohingyas: Inside Myanmar’s Genocide.” Bangladesh is once again calling for the establishment of "safe zones" for the Rohingya in Myanmar so that it can begin resettling some of the 1...

The Myth of ‘Bengali Migration’ to Arakan Debunked

By Dr. Habib Siddiqui Abstract Genocidal crimes don’t happen in vacuum and require groundwork from the racist and bigoted elements to state and non-state actors to prepare the support base and mobilize the dominant group to perpetrate such heinous crimes. For decades,...

Deafening silence over Rohingya issue

Harun Yahya

Despite the atrocities being committed against the Muslims of Arakan, better known as Rohingyas, the international community has so far done nothing to protect these people. The world appears to be sitting on the fence, as these people are being systematically persecuted.

This minority Muslim community in Myanmar — termed the most persecuted people living on the face of earth — has been turned into refugees in their own country. The Rohingyas are a people with no civil rights and from time to time subjected to indiscriminate violence. The world became slightly acquainted with these people following the violent attacks and acts of arson of 2012.

It’s Neo-Nazi Racism, Stupid!

Dr. Habib Siddiqui

In his book – Worse Than War – Daniel Jonah Goldhagen says that during mass murders, the murderers themselves, their supporters and those who wish to stand idly by practice linguistic camouflage. And this has been the case with the apartheid regime in Myanmar when it comes to its national project towards exterminating or purging out the Rohingyas.

Muslim influence in the kingdom of Arakan

14 November 2011

Muslim Arakanese or Rohingya are indigenous to Arakan. Having genealogical linkup with the people of Wesali or Vesali kingdom of Arakan, the Rohingya of today are a perfect example of its ancient inhabitants.

The early people in Arakan were descended from Aryans. They were Indians resembling the people of Bengal. “The area now known as North Arakan had been for many years before the 8th century the seat of Hindu dynasties. In 788 A.D. a new dynasty, known as the Chandras, founded the city of Wesali; this city became a noted trade port to which as many as a thousand ships came annually;… their territory extended as far north as Chittagong; …Wesali was an easterly Hindu kingdom of Bengal following the Mahayanist form of Buddhism and that both government and people were Indian..”[1]

ANTI-ROHINGYA CAMPAIGNS, VIOLATIONS OF HUMAN RIGHTS

20 November 2011

In recent months, series of anti-Rohingya campaigns afloat inside and outside of Burma. To the surprise of everyone, inflammatory writings are often posted on a few websites, face books and blogs that reveal deep-seated ill-will against the peace loving Rohingyas.

Muslim influence in the kingdom of Arakan

14 November 2011

Muslim Arakanese or Rohingya are indigenous to Arakan. Having genealogical linkup with the people of Wesali or Vesali kingdom of Arakan, the Rohingya of today are a perfect example of its ancient inhabitants.

Rebuttal to U Khin Maung Saw’s misinformation on Rohingya

02 November 2011

During recent years we have read series of depraved propagandas by a group of fanatics, who are restless to tarnish the image of the Rohingya people, under the pretext of so-called scholars/academics/Burmese experts preaching annihilation of the Rohingyas, a predominantly Muslim community in Arakan, Burma. One of them is U Khin Maung Saw, a Rakhine Buddhist living in Berlin, who recently wrote a foul-mouthed and blasphemous paper titled Islamization of Burma Through Chittagonian Bengalis as “Rohingya Refugees”.

Rohingya History

Rohingya History

The Significance of the term “Kula” for the Rohingyas and the Burmese Muslims

In ancient times dark skinned people dotted around the coastal regions from Africa, south India, up to the Papua New Genia. Under attack from the light skinned organized band of people from the north against these dark skinned Negroids (seen not being quite human, or at best demons,) these people continued to retreat to the coastal areas and in some places under pressure slowly disappeared. In Malaysia, the majority muslim population is a crossbreeds between these dark skinned people with Indian, Arab, Negroid, and Mongoloid population.

The advent of Islam in Arakan and the Rohingyas

The advent of Islam in Arakan and the Rohingya presented at the Seminar organised by Arakan Historical Society at Chittagong Zila Parishad Hall, Chittagong, on December 31, 1995, with Co-operation Chittagong University.

Rohingya Culture

ARNO welcomes the Bangladesh Government’s decision to offer formal education to Rohingya refugee children

Arakan Rohingya National Organisation (ARNO) greatly welcomes the decision of the Government of Bangladesh to offer schooling and skills training opportunities to Rohingya refugee children, two and half years after they were forced to flee genocide in Myanmar. ...

Myanmar Cuts Off Aid to Devastated Rohingya Populations

As of last week, a humanitarian crisis began unfolding in Myanmar’s north eastern Rakhine state, as aid agencies, such as the International Rescue Committee and the International Organisation for Migration, have been blocked from entering the townships of Rathidaung...

OIC General Secretariat Welcomes UNGA Resolution Condemning Abuses against Rohingya

Date: 29/12/2019 The General Secretariat of the Organization of Islamic Cooperation (OIC) welcomes the United Nations General Assembly resolution strongly condemning rights abuses against Rohingya Muslims and other minority groups in Myanmar. This resolution follows...

Rohingya Books

MYANMAR: A People Facing Buddhist Violence

Myanmar (formerly known as Burma) has a population of 48 million, 15 percent of whom are Muslims. Most of the rest are Buddhists. The Muslims live in the Arakan region of the country.

Burma’s Lost Kingdoms: Splendors Of Arakan by Pamela Gutman, A Book Reviews

Al-Jazeerah, January 13, 2006